Recently, the market has been trading on expectations of a supply deficit in Indonesia, while non-ferrous metals have generally risen amid macro events, driving nickel prices and high-grade NPI prices steadily higher. Against a backdrop of sluggish end-use consumption, what is supporting the continuous rise in high-grade NPI prices? The detailed analysis is as follows:

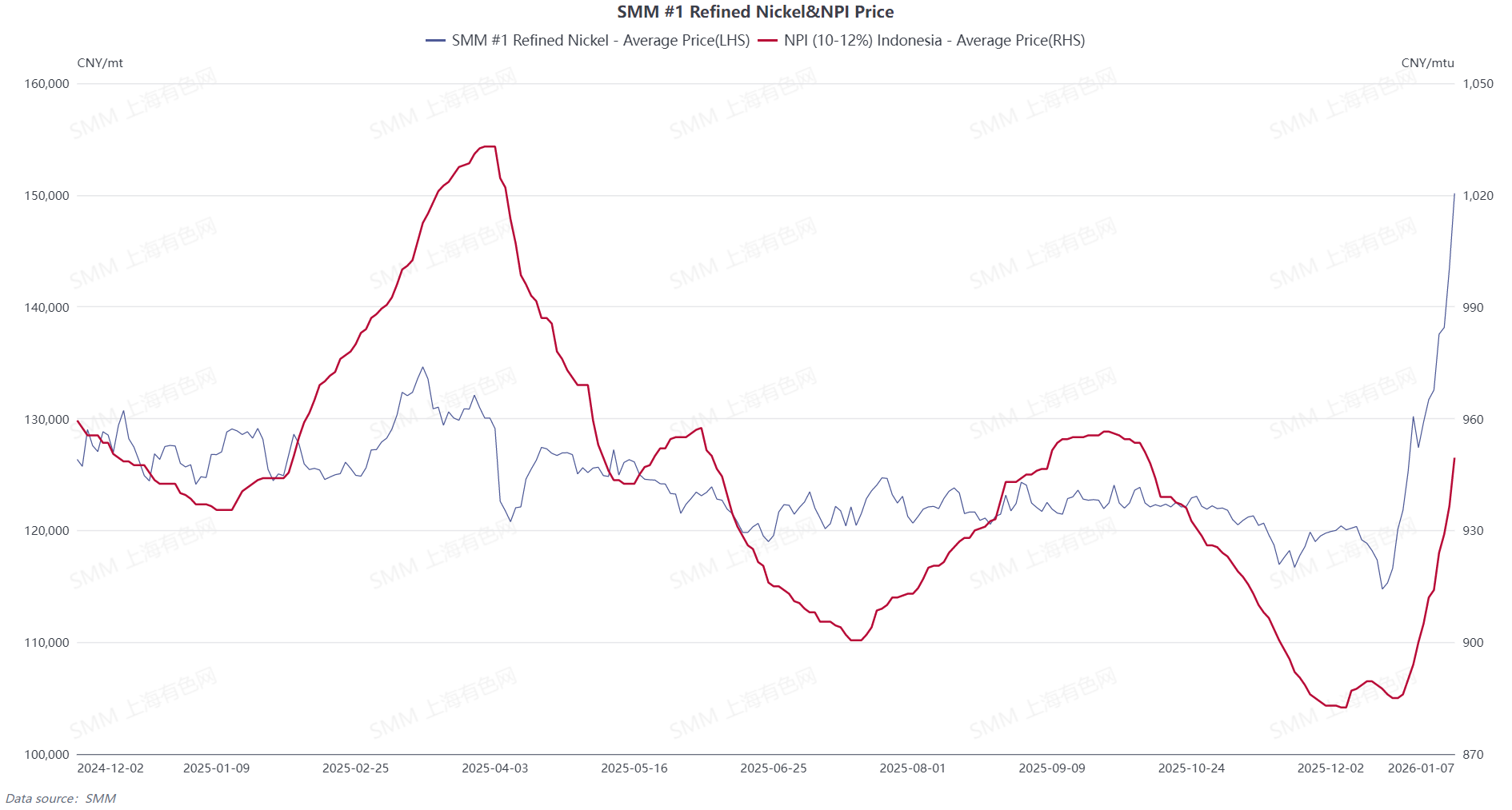

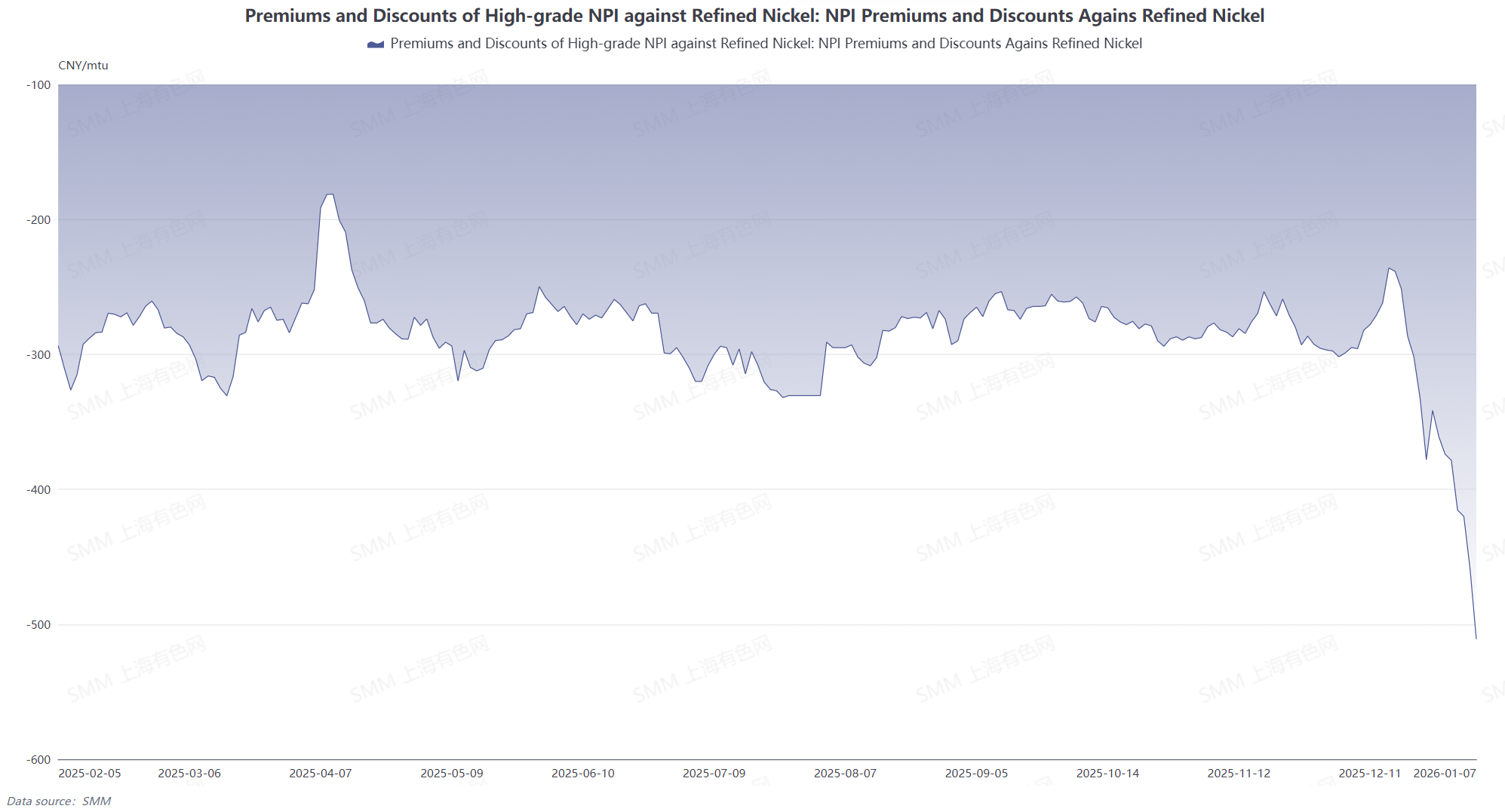

As shown in the figure above, the increase in refined nickel prices has already exceeded the 2025 high, while high-grade NPI prices, though continuing to rise, have not yet reached historical highs, primarily due to different drivers behind the two price increases.

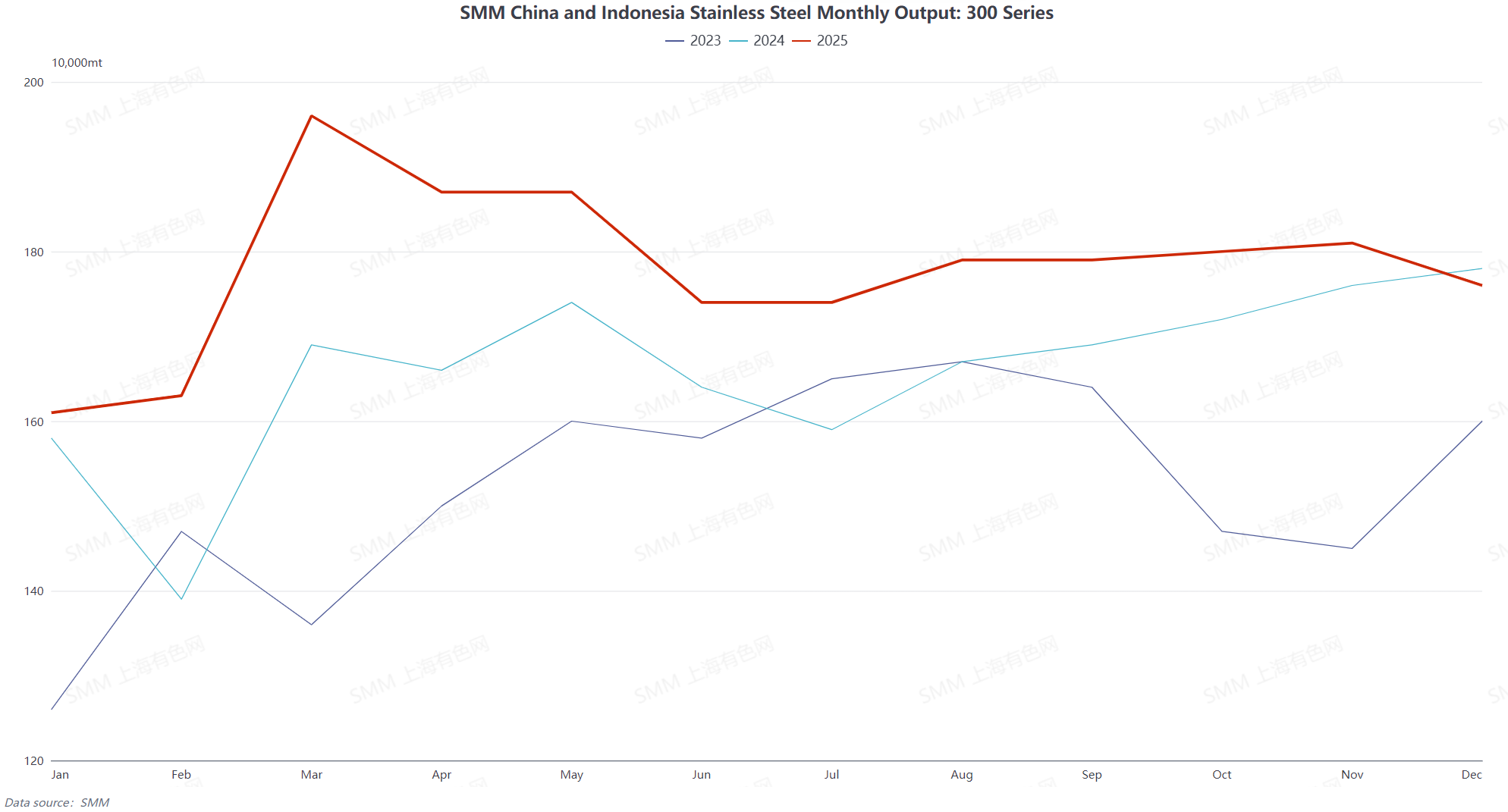

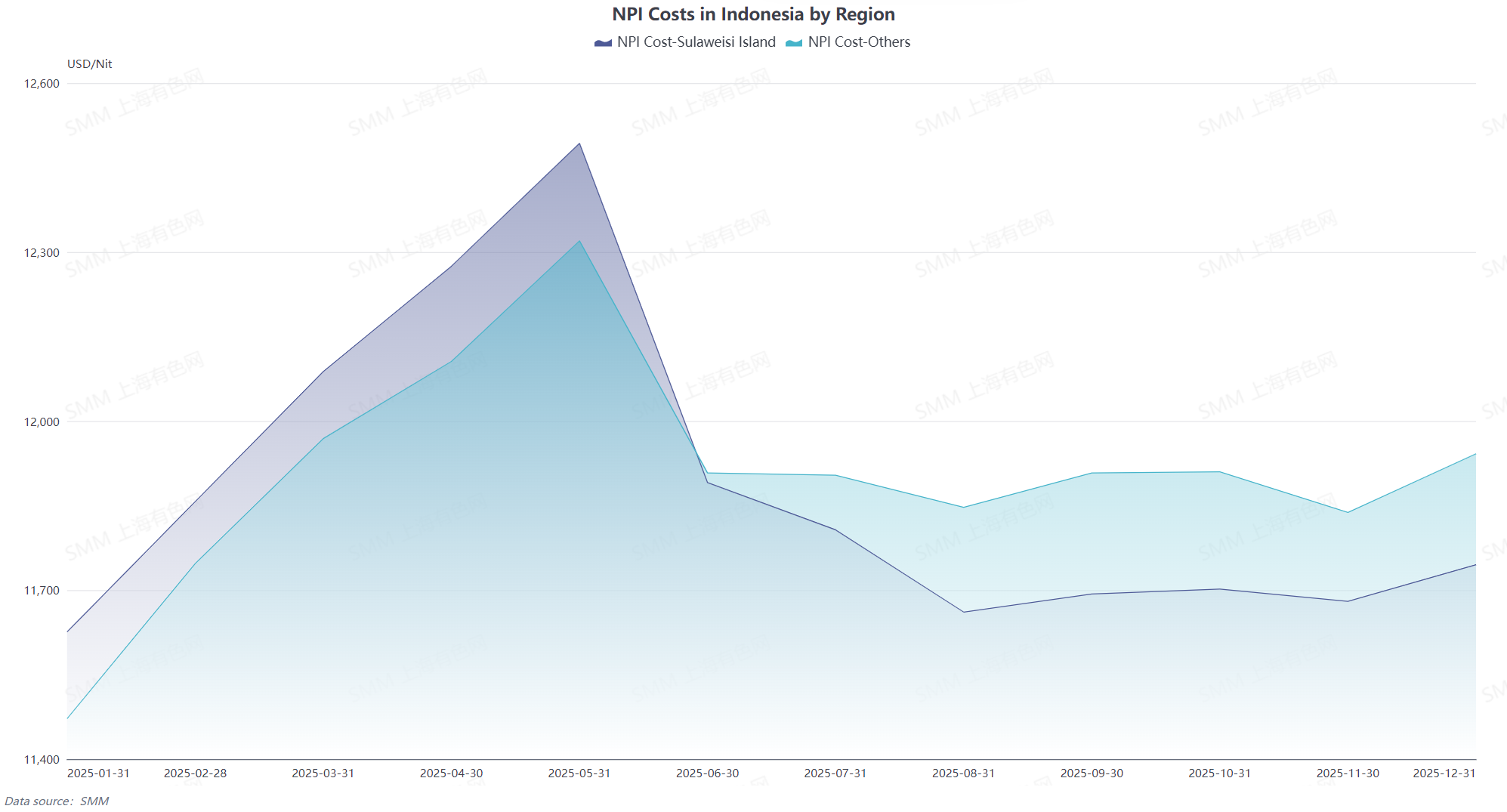

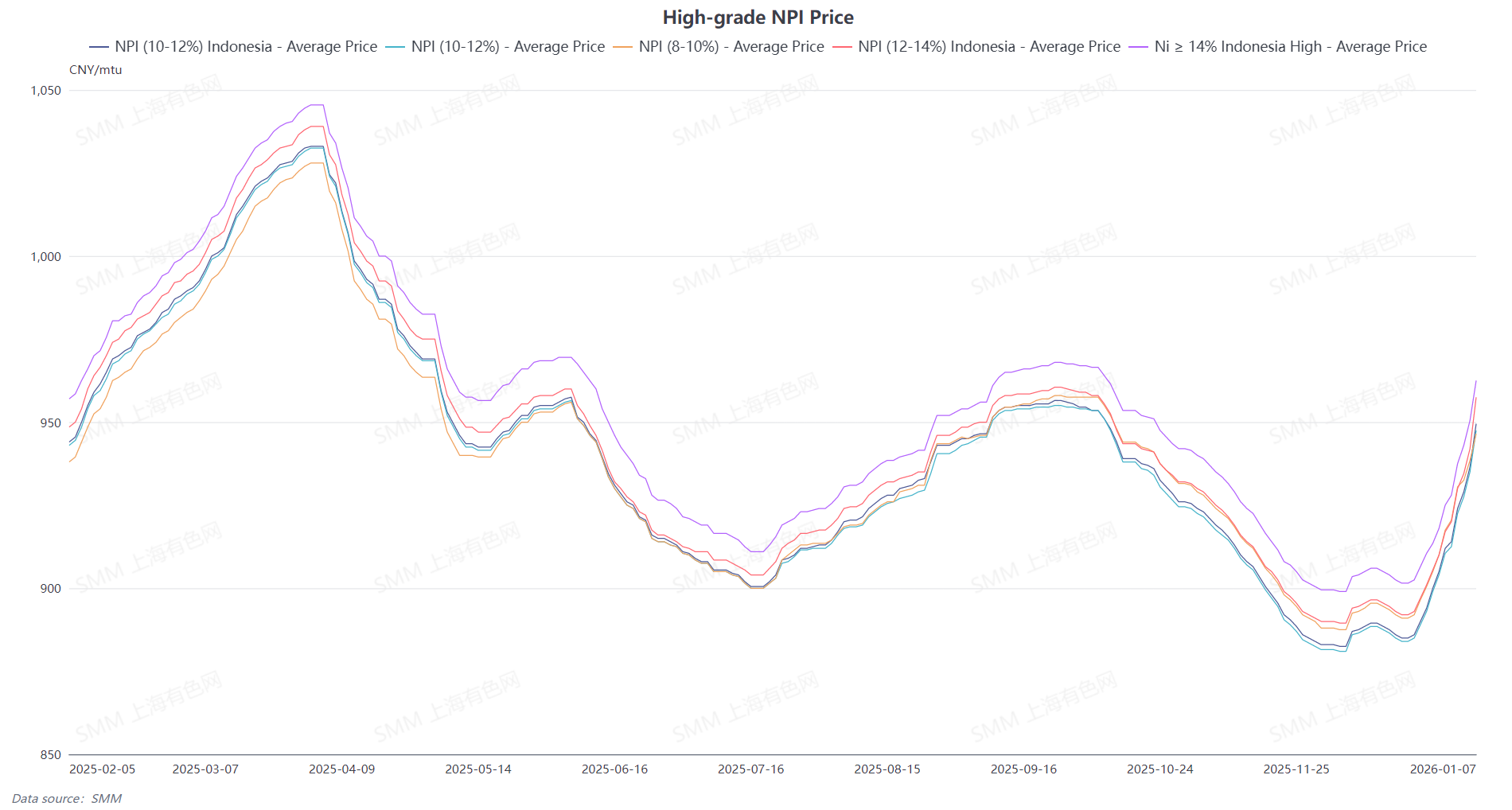

In March-April 2025, Indonesia faced supply-side disruptions from the rainy season and slow RKAB quota approvals, leading to higher ore prices and increased costs. At the same time, the domestic stainless steel "Golden March" trend materialized, with 300-series stainless steel production hitting a record high in March, significantly boosting demand for high-grade NPI. As a result, driven by both macro and fundamental factors, the SMM 10-12% high-grade NPI delivered tax-included price rose to a high of 1,033 yuan/mtu.

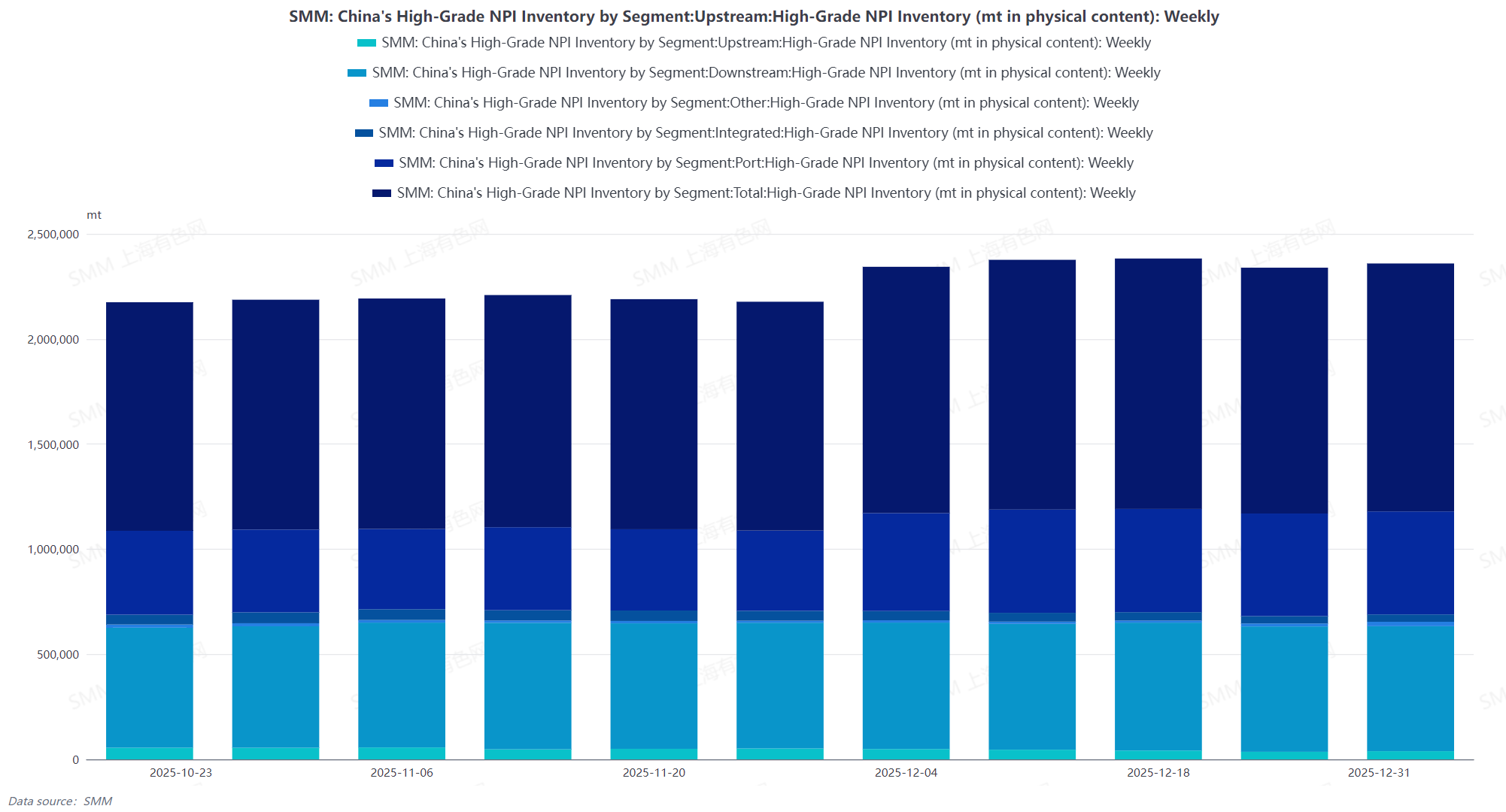

In contrast, the current situation, while also influenced by supply deficit expectations and macro sentiment, sees domestic stainless steel end-use consumption still in the off-season. 300-series stainless steel production is expected to decline consecutively in December 2025 and January 2026. Although finished stainless steel prices have followed futures higher, actual demand has not grown, and supply remains relatively stable. SMM high-grade NPI inventory remains high, with large steel mills having largely completed pre-holiday stockpiling. Only some small special steel mills have restocked for rigid demand, making it difficult to find fundamental support for high-grade NPI. Additionally, as ore prices have pulled back from highs, high-grade NPI costs are significantly lower than peak levels. Due to declines in both ore and auxiliary material prices domestically, high-grade NPI profit margins have turned positive in some regions.

From the perspective of specific transaction prices, currently, most stainless steel mills' intended and actual transaction price center for 10-12% NPI is at 950-960 yuan/mtu. Meanwhile, some upstream enterprises have raised their quotations to above 980-1,000 yuan/mtu, with a large number of traders and downstream enterprises engaging in high-price transactions, with the transaction price center at 980-995 yuan/mtu. The main reason lies in the significant rise in nickel futures recently, highlighting structural arbitrage opportunities, and the continuous warming up of arbitrage sentiment among upstream and downstream enterprises in the industry chain. As a core product in the nickel industry chain, the price spread fluctuations between non-standard high-grade NPI, SHFE nickel, and stainless steel futures have become one of the key logics behind this round of arbitrage trading.

Against the backdrop of rapidly rising futures prices, the current price difference between the two is at a stage high, mainly driven by macro factors despite weak fundamentals, making it highly likely that the price spread will narrow in the future. Based on this judgment, a large number of enterprises in the industry chain are actively positioning themselves for arbitrage operations, locking in the price spread between futures and non-standard high-grade NPI to profit from the narrowing process. Consequently, there has been a significant increase in high-price transactions above 980 yuan/mtu, leading to a noticeable price difference in market transactions. Additionally, it is worth noting that the recent market has seen a relative shortage of high-nickel content supplies, with 12-14% and over 14% high-grade NPI prices leading the gains, widening the gap with 10-12% NPI, while the premium space for 8-12% high-grade NPI has gradually narrowed.

Looking ahead, today's stainless steel finished product prices have significantly rebounded. From the cost perspective of stainless steel, considering the prices of stainless steel scrap and high-carbon ferrochrome, the cash cost of 300-series stainless steel is beginning to recover. If the recovery trend in stainless steel prices can be sustained, it is expected that stainless steel enterprises' acceptance of high-grade NPI prices could gradually increase to 980 yuan/mtu within a month, with further upward potential.